Introduction to Retirement Planning

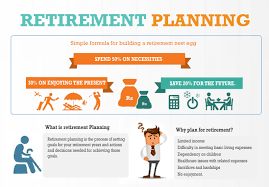

Retirement planning is a comprehensive financial process that individuals undertake to secure their financial future after leaving the workforce. It involves setting clear financial goals, estimating future expenses, and devising a savings and investment strategy to ensure a comfortable retirement lifestyle. A crucial aspect of retirement planning is understanding pension pots and their role in providing income during retirement.

What is a Pension Pot?

A pension pot represents the accumulated savings and investments held within a pension scheme or account, intended to provide income during retirement. It consists of contributions made by the individual, employer contributions, and any investment returns generated over time. The final amount in the pension pot upon retirement is influenced by several factors, such as the amount of contributions made, the performance of investments, and the length of time the savings have been accumulating.

Understanding Private Pension Growth

When strategizing for retirement, it becomes imperative to gauge the prospective value of your private pension growth, considering factors like your contributions, investment returns, and retirement age. Although pension pot calculators offer a broad overview of potential pension growth, comprehending the underlying elements is crucial for adept retirement planning. It’s about more than just numbers; it’s about securing money for fun during your retirement years. By thoughtfully evaluating these factors, individuals can make well-informed decisions about their pension savings, ultimately paving the way for a retirement that not only meets financial needs but also provides funds for enjoyable pursuits.

Factors Affecting Pension Pot Growth

Several key factors influence the growth of pension pots:

- Contribution Levels: Higher contributions over time lead to larger pension pots at retirement. Consistent and regular contributions enhance the growth potential of the pension pot.

- Investment Returns: The performance of pension investments significantly impacts pot growth. Favorable investment returns, compounded over time, contribute to accelerated growth, while poor investment performance may hinder growth.

- Inflation: Inflation reduces the value of money over time, impacting pension savings. It’s essential to consider inflation when projecting future retirement income and adjusting savings accordingly.

- Investment Costs: High investment costs, such as management fees and charges, can eat into investment returns and reduce the overall growth of pension pots. Minimizing investment costs helps maximize growth potential.

By comprehending elements such as financial objectives and risk tolerance, individuals can make well-informed choices regarding their retirement savings.

Importance of Regular Review and Adjustment

Retirement planning is an ongoing process that needs to be regularly reviewed and adjusted to remain effective. This is because life events, such as marriage, having children, buying a home, or experiencing health issues, may impact the retirement plans. Similarly, changes in financial circumstances, such as a job change or the loss of a spouse, may require revisions to retirement plans. Additionally, market fluctuations can also impact retirement plans, making it necessary to reassess savings goals, investment strategies, and income targets on a regular basis. Individuals can ensure a comfortable and secure retirement by regularly monitoring and modifying their retirement plans to meet their objectives.

Conclusion

In conclusion, understanding pension pots and private pension growth projection is essential for effective retirement planning. By comprehending the factors influencing pension pot growth and regularly reviewing retirement plans, individuals can optimize their savings and investment strategies to achieve financial security in retirement. With careful planning and ongoing monitoring, individuals can embark on their retirement journey with confidence, knowing they have prepared adequately for their financial future.