Introduction:

Selling a property with the potential for significant profits can trigger worries about associated tax responsibilities. Have you heard about the 1031 exchange? It presents a strategic opportunity for investors to postpone capital gains tax upon selling their business or investment properties. Interested in delving deeper? Nevertheless, navigating the intricate rules and mechanisms of 1031 exchanges can be perplexing. This guide is designed to offer a lucid explanation of the workings of these exchanges, along with crucial considerations and rules to bear in mind. Plus, we’re offering free budgeting sheets to assist you in managing your finances effectively.

Understanding the Basics:

What is a 1031 Exchange?

It’s a smart way to defer capital gains tax by reinvesting sale proceeds into a similar property. It’s like a secret weapon that can help you preserve your hard-earned money while investing in a new property. Commonly referred to as a “like-kind” exchange, this strategy is rooted in Section 1031 of the U.S. Internal Revenue Code.

Qualifying Properties:

Business or investment properties are eligible for 1031 exchanges, excluding personal-use properties like primary residences or vacation homes. Securities and financial instruments do not usually qualify for this exchange.

Navigating the 1031 Exchange Process:

Step 1: Identify the Property:

Choose the property you intend to sell, ensuring it aligns with the criteria for business or investment properties.

Step 2: Identify the Replacement Property:

Select a like-kind replacement property, ensuring compatibility in nature, character, or class.

Step 3: Engage a Qualified Intermediary:

To prevent premature cash receipt, work with a qualified intermediary who holds funds in escrow until the exchange concludes.

Step 4: Determine Reinvestment Amount:

Decide the portion of sale proceeds to reinvest, as only the reinvested amount is eligible for capital gains tax deferral.

Step 5: Adhere to Timelines:

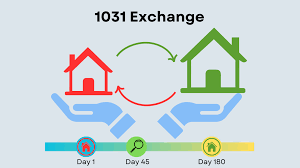

Respect the 45-day identification period for potential replacement properties and the 180-day acquisition window.

Step 6: Safeguard Funds:

Maintain caution regarding access to funds, as taking control before the exchange completion may jeopardize tax benefits.

Step 7: IRS Reporting:

File IRS Form 8824 to report transaction details, including property descriptions, timelines, involved parties, and financial specifics.

Key Considerations and Rules:

- Tax Deferral, Not Elimination:

- A 1031 exchange delays capital gains tax but doesn’t eliminate it. Be prepared for eventual tax obligations.

- Broad Interpretation of “Like-Kind”:

- Properties don’t need identical features; “like-kind” refers to exchanging one investment property for another.

- Selecting a Qualified Intermediary:

- Ensure the intermediary isn’t a relative, attorney, banker, employee, accountant, or real estate agent.

Types of 1031 Exchanges:

- Simultaneous Exchange:

- Buyer and seller exchange properties simultaneously.

- Deferred Exchange:

- Properties are exchanged at different times but form integrated transactions.

- Reverse Exchange:

- New property purchase precedes the sale of the old property.

Beware of Scams:

Exercise caution against 1031 exchange scams. Verify that advice aligns with IRS regulations, and be wary of claims suggesting tax-free transactions.

Conclusion:

A 1031 exchange stands as a valuable tool for deferring capital gains tax, offering a strategic approach to property transactions. Navigating the intricacies involves careful adherence to rules, engagement with qualified intermediaries, and understanding the eventual tax implications. As with any tax-related strategy, seeking guidance from tax professionals ensures compliance and maximizes the benefits of a 1031 exchange.